Most traders and investors think they must be constantly in pursuit of alpha, they are the pursuit predator, more trades mean more profit. They are willing to take lesser odds so long as they can make incremental profits., Take small risks, with mediocre strategies, and make small profits, and just keep that going like a machine. I’ve got to say, I have yet to meet anyone that can keep this machine running for very long before it all comes crashing down, and then they build a new machine using the same plan.

We don’t do this here at Asymmetric Advisor, in fact we are the ultimate contrarians to this approach. We are ambush predators, we sit and wait for the right opportunity when all the odds are in our favor, and then we pounce, and hit it hard, looking for great returns with little energy spent. This approach requires great patience and understanding of your prey.

Some people might call it a variation of Black Swan investing, but we don’t have time to wait for that once in a decade opportunity. On the other hand, if there is such an event once in a decade, we’d like to participate, like the great opportunity that is upon us due to the Wuhan CoronaVirus crisis. We will certainly take advantage of it, be patient, identify asymmetric opportunities, and attack them with greta force. This method requires that you have plenty of dry powder, plenty of cash on hand.

We buy things that have become cheap relative to their value, or find opportunities for take over or acquisition. It’s like going to the casino to play Texas Holdem, a variation of Poker, where we only play when we are dealt pocket Aces, the best possible starting hand. Or to take a baseball analogy from the investing legend Warren Buffet.

Buffet says investing is like playing baseball where there are no called strikes, and you don’t get penalized for not swinging. You can just stand there and wait for only the fattest pitches right down the middle of the plate, giving you the best possible chance to get a hit, and get on base or hit a home run. You could stand at the plate all year long and not swing until the odds are overwhelmingly in your favor.

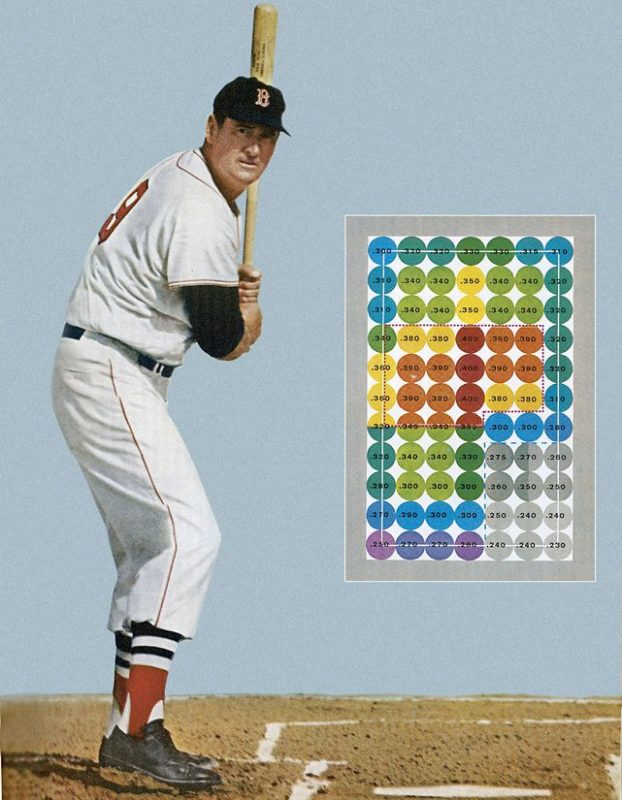

Ted Williams, the Boston Red Sox hall of famer, wrote a book called The Science of Hitting. On the front cover was the strike zone, and the hitting average he could attain the highest chances of getting a hit. He knew that if he could be patient and wait to swing only at the best pitches, then he could get a hit and get on base. It worked for Ted as he was the last baseball player to hit with a 400 average the entire season. A record that has stood since 1941.

This is what we do. It takes patience, and great understanding to recognize the opportunity and value, that point where the odds are in your favor to make great returns.