If you have followed my work for any period of time, or if you had asked me to recommend some books on trading, you may have been surprised when I recommended a series of books that don’t really talk about trading much at all. The series author is Nassim Taleb, academic mathematician, philosopher, author and former hedge fund founder. I refer to his series of books as perhaps the best treatise on the way the world works, geared towards a trader, investor or politician, ever written. The books are made up of numerous allegories, with a few characters or tribes that span some of the volumes.

The five books that I refer to are; The Black Swan, Fooled by Randomness, Antifragile, Skin in the Game and The Bed of Procrustes. The Asymmetric Advisor investment philosophy is largely based on the themes described in these books, in particular The Black Swan and Antifragile. By the way, if you are an Audible member, or even if you are not, I highly recommend that you get the Audible versions of these books as the stories come alive with excellent narration. And as a member of this service, I HIGHLY RECOMMEND that you read/listen to all these books.

This report will focus mainly on concepts derived from Antifragile: Systems that Gain from Disorder. This is a strategy designed to achieve asymmetric gains in times of high volatility or tail risk such as what we recently experienced in the COVID-19 Pandemic, or the 2008 Financial Crisis, or the 2001 Dot-Com Bubble Burst, and many similar Black Swan events, with a Long Volatility strategy.

When you combine this strategy with short volatility assets like stocks, bonds, real estate and other private equity like gold, you create a diversification of strategies that when combined achieve superior performance, with reduced drawdowns, regardless of the market cycle. Just remember the Long volatility is no different than buying insurance, there’s a premium you must pay, and hope that the benefit never has to be collected because of the economic situation it implies. However, we have to be realistic, and know for sure that it is likely to happen eventually, if we are in the market for a long time. The goal is to get paid, and paid handsomely, if that insurance benefit needs to be collected.

Don’t Underestimate the Insurance You Need

The 2nd book I read in the Nassim Taleb series was Fooled by Randomness, the main point was to demonstrate how bad we are at estimating or predicting how bad things can get. Every time things get super bad, we say things like…”It’s never been this bad before, it was totally unexpected.” This happens virtually every time some huge calamity comes along, you think we would learn by now and construct homes and environments that would prepare us, but we don’t.

A few people see the writing on the wall, but most will scoff at them as heretics or simply ill-informed, maybe a bit crazy. Watch the movie The Big Short about a group of such people that saw the 2008 mortgage crisis coming and profited huge by making some unconventional bets. Let me ask you this, could you have ever conceived that our current pandemic would have kept us in lockdown in our homes for months? Were we prepared, or is this something you simply can’t prepare for?

The Modern Portfolio Theory (MPT) attempts to tackle this idea of risk by assembling a portfolio of assets that are equally weighted in terms of risk and expected return. The idea is using the law of big numbers, that if you have a sufficiently diversified portfolio, then you’ll be protected in many market conditions…except the ones that really hurt. That’s the problem with MPT, is suffers from the Fooled By Randomness syndrome.

What is needed is a radical approach, no holds barred, and actually simpler make up, where tail risk is assumed to be worse that we could ever imagine (big long volatility position), that inflation could spiral completely out of control (huge gold position), and that a slow grind in equities is a lot of work for little or no gain, so make bold bets with asymmetric risks (natural Resource investing). Combine these strategies with some conventional ones for the more sedate periods, like bonds and commodities, and you have a portfolio that will survive any market.

The Dragon Portfolio

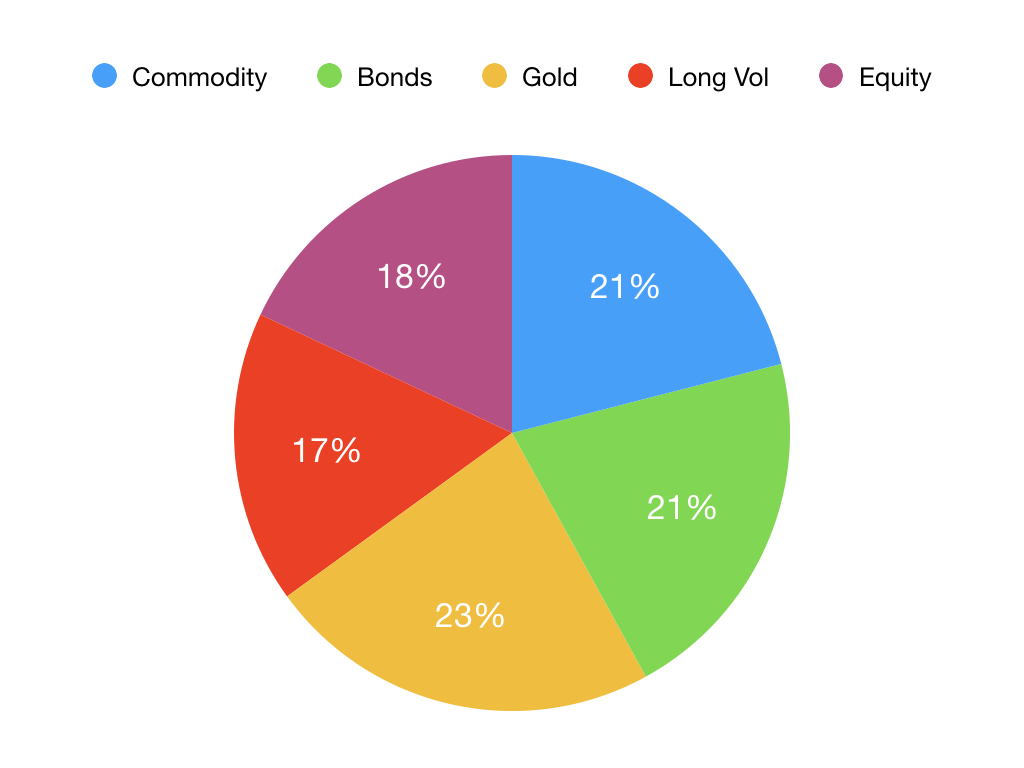

A 100 year study was conducted by Artemis Capital Management, led by founder Christopher Cole, which backtested five non-correlated strategies including; Gold, Equities, Fixed Income, Commodities, and Long Volatility. What he found was almost an equal allocation distribution of these five strategies outperformed every other modern portfolio management theory by a wide margin, and did so regardless of market condition. The two strategies that stood out were the high allocation for Gold and Long Volatility. Below shows the allocation that Cole found to be optimal over the past 100 years or so.

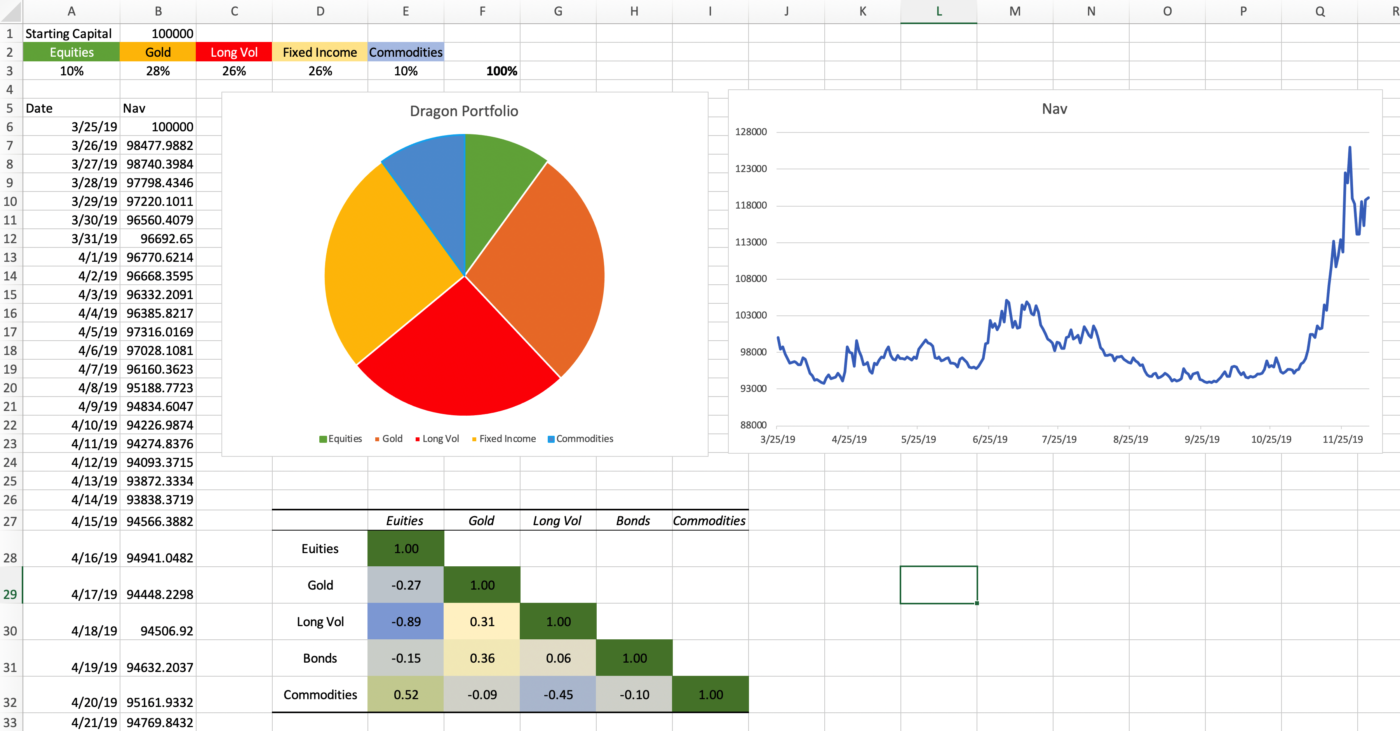

This is a huge departure from the MPT and outperforms by nearly 2X. Our goal this month is to model this portfolio in a basic way and to model the Long Volatility strategy in a more specific way. You can download the excel model for the Dragon Portfolio here. Below is what the spreadsheet looks like. It assumes a starting capital, and allows you to enter your preferred allocation for each of the strategies.

This sample portfolio only has about a year worth of data, but that includes the recent massive downturn due to the COVID-19 pandemic. The model includes a correlation matrix showing the low degree of correlation between the five strategies (data sets).

Long Volatility

The example dragon portfolio substitutes the VXX ETF for the Long Volatility strategy. However, a more effective implementation would be using long PUT options on the SPY. This would result in a much more efficient use of resources and provide a much bigger payout should the market turn down than by simply holding VXX shares.

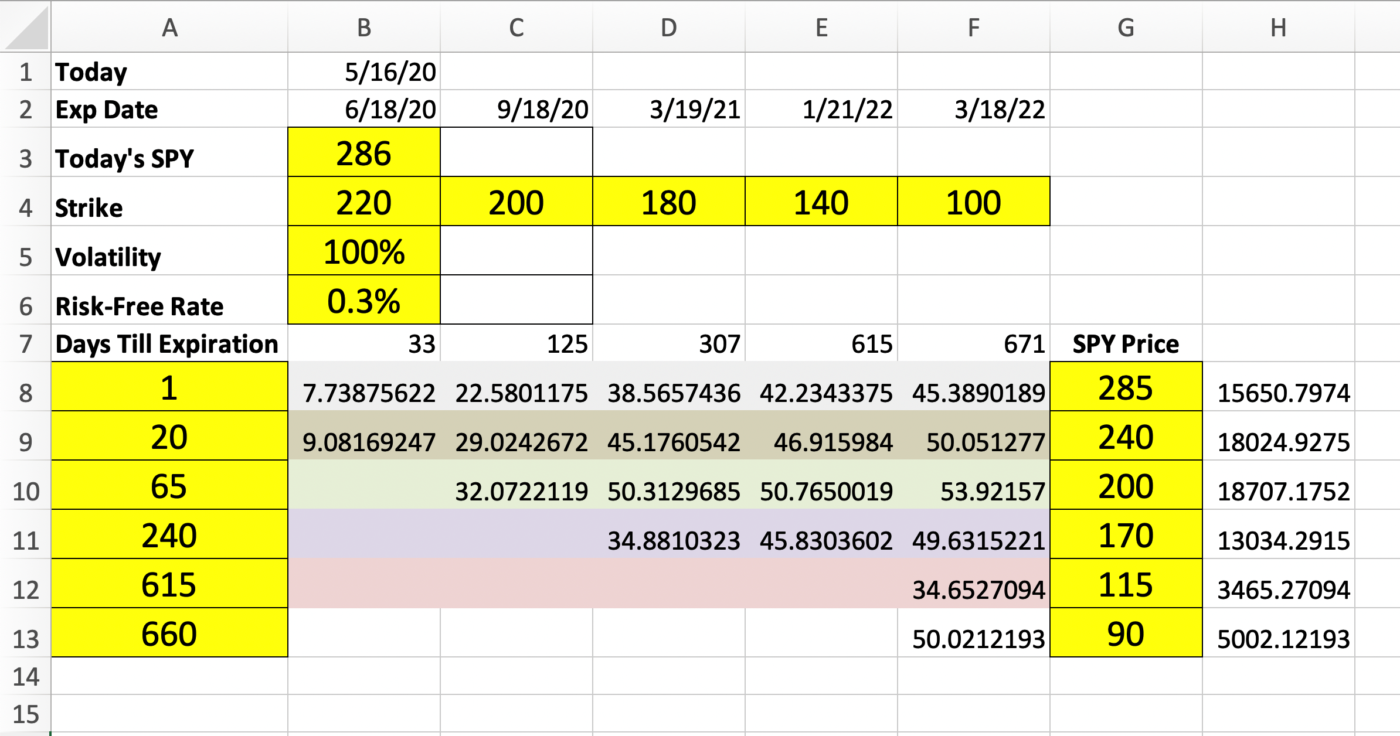

The strategy is to maintain a spread of options contract expirations, from near term to long term (LEAPs). Over time the near term options would expire, and it would require that you either purchase new contracts, and continually maintain the spread of expirations. Below is a spreadsheet that simulates option pricing in this Long Volatility strategy using the Black Scholes model.You can download the spreadsheet option_calculator_mod here.

hi,

Regarding replacing the VXX with put options, how would that work? (mechanics) If you buy near term puts, they will expire worthless if nothing ‘bad’ happens and the leaps will also slowly lose value.

Another question: what part of the Long Vol will be leaps and what part near term ?

The first thing you must settle with is the Long Volatility strategy is a slow leaker of capital, in other words, insurance is an expense. The second is that you have to decide how much insurance and how aggressive you want to be. Remember that you are trying to model an economic collapse with the Puts, so you need to consider that it could be a long-lived downturn, so LEAPs out two years is not out of the question. LEAPs are not fundamentally different from shorter term options, they are just long dated.The idea is you want to spread your protection out, how you do that will reflect how you model the hypothetical collapse.

Pingback: June 2020 Summer Time is Radio Active – Asymmetric Advisor