This is not the way I expected a monthly outlook for the Asymmetric Advisor to go. I would have much rather had 5 opportunities all laid out, with ideas on the amount of capital I was willing to deploy. But the facts are, in the midst of what may become the most significant social and financial events in our life times (I hope there won’t be more like this), it is much more prudent to sit on our collective hands and watch and learn.

This does NOT mean however that I’m not scoping out opportunities, far from it. And in this months outlook will be posted in 3 parts, first the overall outlook on oil and then part 2 will be about gold, and part 3 will have specific recommendations.

-

- The Best Way To Play Oil

- Gold Industry Outlook

- First Tranche Investments

PART 1. Oil Sector Strategy

Remember the Goal of AA

Our primary strategy is to play the resource sector, and look for asymmetric opportunities. And while there are incredible boom and bust cycles reflected in the overriding commodity, like physical Gold or Crude Oil, the real opportunities are with the suppliers, refiners and other related companies at various stages of development or acquisition. So, we take a multi pronged approach, we invest in the physical for relative stability, but our primary asymmetric bet is with these companies.

With oil that means rigs, refineries and pipelines. In this downturn, we are looking for high quality companies that are undervalued, or can be had at a deep discount to their intrinsic value, buy and hold them, take enough profits to cover our costs (ROY) and then collect dividends.

The Situation

Let’s first understand what’s going on in the industry, why we had negative oil prices in the futures market, where storage is at, what the hell is going on between the Saudis and Russia, how the Wuhan Coronavirus impacts it all.

Prior to the WHO recognizing we had a pandemic on our hands, members of OPEC were in a bit of a spat, namely the Saudis and Russia. They played word games threatening to increase production, then promising to cut production, blah, blah, blah.

Then the Saudis, not to be outdone by the Russians, announced they would increase production, and so the Russians vowed to keep pace and increase daily production by 12 million barrels, bringing the total to 103 million barrels per day.

None of this bickering never materialized into actual increase or decrease in production, but it certainly had an affect on prices as they dropped dramatically, and simultaneously, like a perfect storm, COVID-19 started to cause the shutdown of world economies. The Saudis then dumped millions of barres of oil onto the market which caused oil prices to free fall, and oil supply became maxed out.

The continued into April with the new May contract, and as we got to the end of that contract. oil price still dropping as economies completely shutdown, speculators realized they couldn’t cash in their futures contracts, as hedgers wouldn’t buy them because there was no place to store the oil…we got a no bid situation, and oil prices spiraled down into negative territory…I’m sure many lives were ruined.

Fortunately all parties have decided to calm down after Trump threatened them, with what I’m not sure, he also vowed to support the big oil companies to keep everything more stable and energy flowing to every part of the country and world.

The Problem Remains

So, here we are in late April, and COVID-19 has not gone away, we’re all still in lock down, storage for oil is maxed out, and economic activity is pretty much near zero, except for essential services, like power, internet, food supply chains, medical facilities and a spattering of other things considered essential.

People are getting restless and worried and angry. 30 percent of the workforce is unemployed, maybe 40 percent by the time you read this. Many states are vowing to open up for business, regardless of the pandemic, as we are becoming aware that the cure is worse than the bug.

Airlines are essentially shut down, hotels, most factories, demand for gasoline and jet fuel has decreased by more than 50 percent, so don’t expect oil supply to go down any time soon, perhaps well into the summer. Hopefully as people come back to work, the engine of the economy will get things moving, as stagnation is the worst possible condition, which eventually will lead to mass hysteria and death from things other than COVID-19.

Near Max Capacity

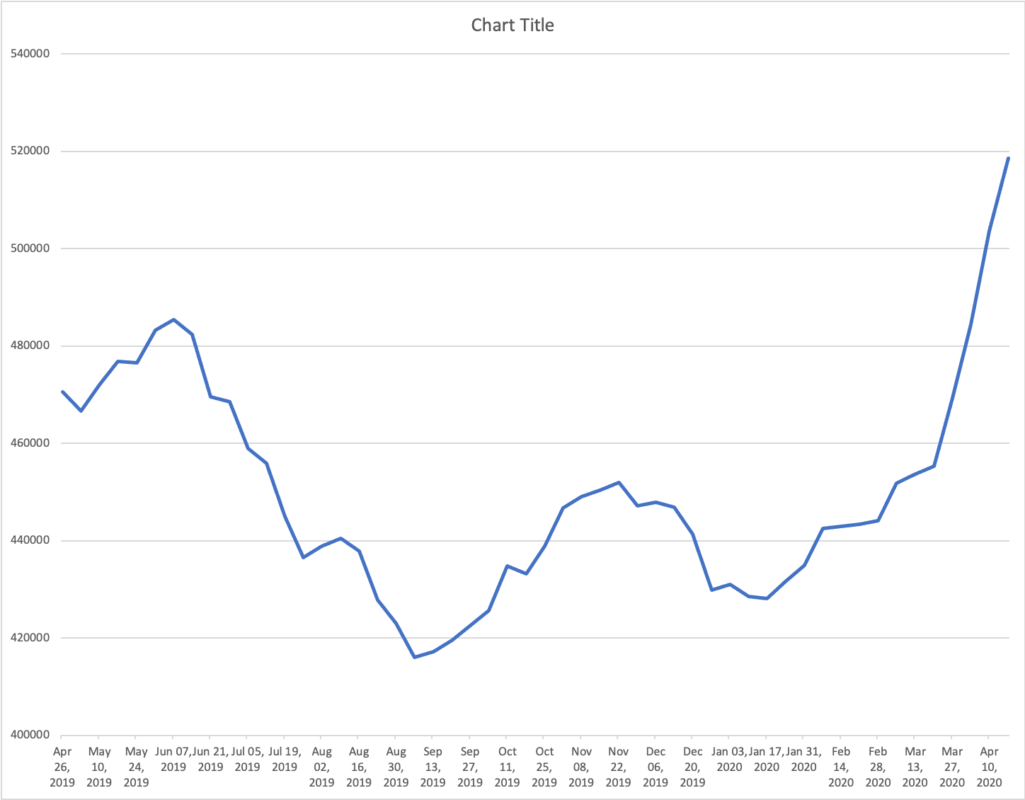

This chart, data taken directly from the EIA website, shows inventory at 520 million barrels, but that is from more than a week ago, today is April 23rd, and according to yesterdays EIA Petroleum Status Report we have added 15 million more barrels.

Our absolute total capacity is 650 million barrels, which means by mid summer we will have no more capacity and wells will need to be shut down, unless we can tap floating storage, which is all ready near peak capacity of 120 million barrels.

This all means that in a few short months, if we don’t get the economies going, we’ll have to shut down oil wells, which might seem like an option to some, but the implications of that would be devastating, as shutting down many wells would mean not getting them back online for a long time due to the technicalities of shutting dow a well and closing pipelines. The system isn’t designed to stop, is the basic problem.

Where Supply Meets Demand

So, the only natural course of action is to cut supply. President Trump has been in negotiations with OPEC, and it looks like they have agreed to cut production by as much as 20 million barrels a day.

This is fine for the current situation, but what happens when people start getting back to work and demand starts to increase? And can they actually cut 20 million barrels a day? Nobody knows. The wild card being Russia, because cutting production would mean severe hardship on their economy because once some of these wells are shut down, as mentioned before, they won’t be coming back online when demand picks up.

Oil is fungible, meaning that all producers (Saudis, Russia, the US, Canada, etc) pour their oil into one big pot that everyone shares. OPEC nations make up a major portion of that pour, but each individual nation has their own specific problems in the event of cutting production or shutting down wells.

The question becomes, who’s going to sacrifice themselves for the “greater good?” Almost sounds like a line straight from Ayan Rands novel, Atlas Shrugged! Holy shit!

Bankruptcies Are Coming

The normal mode of operation (MO) is for companies to adjust their output to account for fluctuations in the order of plus or minus 1 million barrels a day…that’s world production, but now we’re talking at least one, maybe two orders of magnitude more. Many smaller suppliers and pipelines simply won’t be able to handle the supply and demand shocks, that will be a series of magnitude 9.0 earthquakes, followed by a continuous stream of aftershocks.

Problem is we don’t know when companies will be destroyed, saved, acquired, etc. But there are certain companies that will benefit from all this, and will likely have their stock price fluctuate in the face of this volatility that if we are patient, we can pick it up and sit on it.

I Like US Pipeline Companies

Why do I like them? because they are the great hidden asset unique to the United States, there are over 1.38 million miles of pipeline in the US, that’s more than the rest of the world combined, a8 times longer than the next closest, Russia.

Pipelines are the cheapest way to transport energy commodities, cheaper than trucks or trains, and those companies that operate them generate billions in free cash flow and super high yielding dividends. Since we’ve become energy independent, these pipelines are expanding, and they will undoubted, once our economy and global supply chains are domesticated, will be huge beneficiaries. So, they are both growth and income plays for us.

Pipelines are the cheapest way to transport energy commodities, cheaper than trucks or trains, and those companies that operate them generate billions in free cash flow and super high yielding dividends. Since we’ve become energy independent, these pipelines are expanding, and they will undoubted, once our economy and global supply chains are domesticated, will be huge beneficiaries. So, they are both growth and income plays for us.

Right now I don’t have a list of specific recommendation, but I’m looking at pipeline companies in the US at bargain prices, but here’s an example; junior provider Shell Midstream (SHLX), a super undervalued company and an excellent deal if you can get it under $10 a share, comes with a strong dividend of 16 percent, the parent company Shell says the dividend is in tact for 2020. Check this link for their current assets. And here you can download their most recent financial report.

I’m currently mapping out which companies are the best investments …as for reference, the biggest by pipeline mileage includes:

| Company | Mileage |

|---|---|

| Magellan Pipeline Co. LP | 9,992 |

| Mid-America Pipeline Co. LLC | 8,083 |

| Plains Pipeline LP | 7,055 |

| Sunoco Pipeline LP | 5,858 |

| Colonial Pipeline Co. | 5,587 |

| Phillips 66 Pipeline LLC | 4,789 |

| Enterprise TE Products Pipeline Co. LLC | 4,356 |

| ExxonMobil Pipeline Co. | 4,213 |

| Enbridge Energy LP | 3,892 |

| BP Pipelines (North America) Inc. | 3,851 |

US Pipeline Information

In the spirit of teaching how to research this subject, let’s start with a basic knowledge of how oil is moved through out the country. The best source for this information is actually the US Government and their website called the:

National Pipeline Mapping System.

Check this out, read up on the Pipeline Basics so you get an appreciation for the breadth of this industry and the infrastructure in place. Many green energy advocates don’t really understand this investment that has been made, and seem to think it can all be disregarded.

I also don’t want you to think we won’t be looking at green renewable energy opportunities, because we will. There’s a lot of promise there and money to be made as green energy becomes competitive with oil. It’s only a matter of time, and better to understand it and be the first to invest in it, then just let it pass you by.